The Corner Newsletter, October 4, 2018: Railroads Squeeze Farmers and Manufacturers for Wall Street — SEC Commissioner Jackson on the Concentration Problem Hurting Small Businesses

In this issue, we look at how Wall Street chokes America's railroads, in turn hurting manufacturers, farmers, and the economy. And SEC Commissioner Robert Jackson explains how an investment banking cartel for IPOs hurts growing small and midsize businesses.

OMI Files Amicus Brief to Supreme Court in Apple v. Pepper

On Monday, Open Markets filed an amicus brief in the Supreme Court in support of the respondents in Apple v. Pepper. In the brief, Open Markets argues that – contrary to Apple’s contention – the market for apps is not open and competitive, but closed and closely regulated by Apple itself. Accordingly, Apple exercises power over both iPhone users and iPhone app developers. Given established Supreme Court precedent on the issue, Open Markets argues that iPhone owners have the right to sue Apple for overcharges resulting from Apple’s monopolization of the retail sale of iPhone apps. If iPhone app developers sued Apple for antitrust damages, they would be seeking redress for a distinct injury – underpayments for their apps due to Apple’s power as a wholesale purchaser. Read the brief here.

OMI Files Amicus Brief to First Circuit Against Illegal Pharmaceutical Monopoly

On September 24, Open Markets also filed an amicus brief in the U.S. Court of Appeals for the First Circuit in UFCW Unions and Employers Health Benefits Fund v. Novartis, supporting the plaintiffs’ petition for rehearing. The plaintiffs sued pharmaceutical giant Novartis for illegally obtaining a patent on its life-saving cancer treatment drug Gleevec by submitting false information to the Patent Office. Patients have to take Gleevec daily, and one year of treatment costs $140,000 (up from $26,000 in 2001). In its brief, Open Markets warned, “The [First Circuit] Court’s decision … threatens to immunize a broad range of misrepresentations and other false submissions to government agencies and courts and allow corporations to abuse governmental processes to monopolize markets.” Although Novartis filed a motion asking the First Circuit to reject Open Markets’ brief, the court accepted the brief on October 2.

ANTI-MONOPOLY RISING:

The German Ministry of Economic Affairs in September released a study to guide reform of the German Act against Restraints of Competition, part of Germany’s antitrust laws. The study’s suggestions include focusing more on efforts by online platform corporations to capture entire markets and acquisitions of competitors to eliminate competition. For an analysis of the report from the “D’Kart” blog in English, click here.

Nine state attorneys general met at the Department of Justice in Washington last week to discuss the power and abuses of large technology corporations. Although Attorney General Jeff Sessions called the meeting to focus attention on alleged attempts by Google and Facebook to “intentionally stifl[e] the free exchange of ideas on their platforms,” the state attorneys general focused instead on the privacy practices and unfair practices of tech giants. Mississippi Attorney General Jim Hood said, “We were unanimous. Our focus is going to be on antitrust and privacy. That’s where our laws are.”

The Israel Antitrust Authority called for comments about “competition in the digital/Internet economy” as part of an effort to “examin[e] the unique aspects of the online world in the Israeli economy, and the interface between these aspects and competition policy.”

Tim Berners-Lee, who is widely credited as the inventor of World Wide Web, this past week launched Inrupt, an app that allows users to navigate Solid, Berners-Lee’s decentralized web platform. Inrupt is designed to allow users to have control over what personal data they choose to share with one another and with corporations. Berners-Lee said Inrupt threatens Facebook and Google by introducing “a complete change where all their business models are completely upended overnight. We are not asking their permission.”

As Wall Street Loots America’s Railroads, Manufacturers and Farmers Suffer

Much has been made recently of the shortage of truck drivers in the United States. Most coverage – like this excellent editorial by The New York Times – has focused on the toxic combination of long hours and low wages.

But there’s another factor in play: the abuse of monopoly power by U.S. railroads. Even as a surging economy increases demand for shipping services, the capital funds that control America’s railroads are cutting capacity, and dumping even more freight onto the nation’s highways.

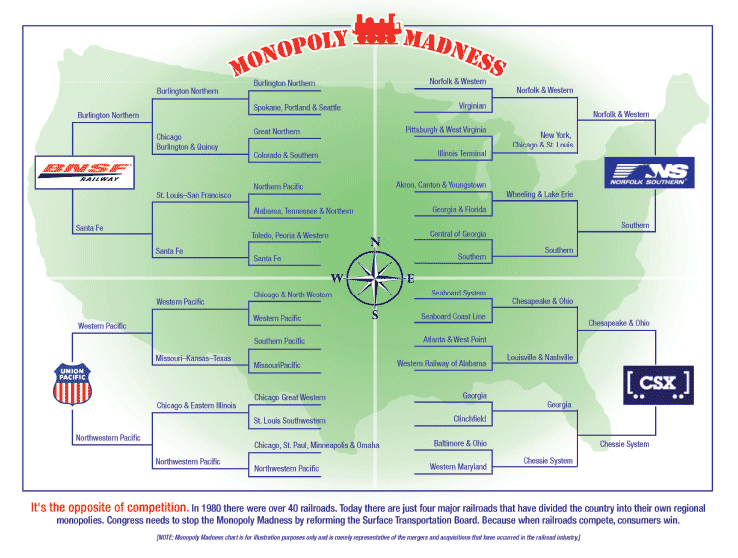

The U.S. market is now dominated by just four railroads, down from more than 40 in 1980. Moreover, since 1980, the industry has been largely deregulated, meaning these corporations can charge whatever the market will bear and cut service however they want.

Over the last two years, for instance, railroad giants CSX and Union Pacific have cut hundreds of routes across the nation. The effort dates back to March 2017, when CSX introduced a program it calls “precision scheduled railroading.” Practically, this has meant less frequent, much longer trains as well as severe cutbacks in the numbers of cities where CSX will pick up or deliver intermodal containers. The railroad eliminated 327 intermodal routes in October 2017, and completely cut off domestic intermodal service to Detroit this past May.

CSX ratcheted up the effort on September 17, when the railroad and Union Pacific cut 197 out of 301 routes that they partner on to ship containers across the Mississippi River. That same day, Union Pacific announced its own service cuts, which it calls “Unified Plan 2020.”

As a result, a shipper who wants to move a container directly by rail from, say, Houston to Baltimore, can no longer do so. Instead, CSX will only take the container as far as Chambersburg, Pennsylvania, where the shipper will have to arrange for a trucker to take the container the remaining 77 miles to Baltimore. If the shipper tries to use CSX’s one remaining competitor in the east, Norfolk Southern, it makes little difference. Norfolk Southern will only take such a container as far as Harrisburg, PA, where the shipper will have to arrange for it to be trucked the remaining 76 miles to Baltimore. Other city pairs that are losing direct service include Denver-Buffalo, Los Angeles-Pittsburgh, and Houston-Philadelphia.

There’s a reason railroads are cutting back: higher short-term profits. Since early 2017, CSX has cut capital investment by 14 percent, laid off 4,000 employees, announced plans to lay off 2,700 more before year-end, and cut back on the total number of trains it runs. The result of this drastic cost-cutting has been a 72 percent increase in net profit in July 2018, over the previous year. Those profits flow to many institutional investors, with Capital Research Global Investors, BlackRock, Vanguard, and State Street numbering among the top shareholders in CSXand Union Pacific.

Union Pacific and CSX declined to comment for this article. CSX referred Open Markets to a September 18 Freight Waves interview with a trucking executive who praised CSX’s elimination of services as helping improve the rail’s “velocity and consistency.”

Ultimately, these profits come out of the pockets of consumers. But the companies most immediately affected include America’s manufacturers and farmers. Ann Warner, a spokesperson for the Freight Rail Customers Alliance, a coalition of companies and trade associations advocating on behalf of freight shippers, says CSX’s cuts increase “the uncertainty of paths that shippers can take to try to secure reliable, cost-competitive, rail-shipping alternatives.”

Farmers are particularly vulnerable to cutbacks in rail service and increases in its price, she says. “Farmers are always very anxious when it comes harvest time in making sure that they’re going to get their grain to market in a time-effective, cost-effective manner.” But there are many other shippers that are completely reliant on the railroads, she says. “There’s just very little choice for most rail shippers amongst all commodities whether it’s cars, pharmaceuticals, agriculture products, chemicals for clean drinking water, coal, manufacturing parts – it just hits such a wide gamut of commodities.”

The effect of the cuts, especially in the run up to the holiday retail season, also puts more strain on the nation’s roads, truckers, and the trucking industry as a whole. In August, trucking firms reported that 98 percent of their rigs were hired out, and that on-short-notice rates are rising. In two areas where CSX is consolidating more shipments, Chambersburg and North Baltimore, Ohio, truckers are harder to find and reluctant to carry goods the longer distances that they need to reach their final destinations.

These developments illustrate the increasingly chaotic nature of the U.S. transportation system today. As OMI’s Phil Longman has detailed, much of the nation’s truck traffic, especially on hauls greater than 500 miles, could be more efficiently moved by rail, and with the added public benefit of relieving highway congestion, reducing energy use, and eliminating vast amounts of air pollution. But meeting the growing market demand for such service requires that railroads make long-term infrastructure investments to increase capacity. Because that would result in a short-term reduction in profits, the financiers who now control America’s railroads won’t go along.

It’s an old story. In his 1914 book, Other People’s Money, Louis Brandeis included a whole chapter, entitled “The Curse of Bigness,” in which he described how bankers were forcing well-engineered railroads to neglect investments on their infrastructure in favor of financial manipulations. Only now America’s railroads are actually far more monopolized and even less regulated than they were a century ago.

WHAT WE’VE BEEN UP TO:

Sandeep Vaheesan spoke at the Federal Trade Commission’s Competition and Consumer Protection in the 21st Century hearings on its “Monopsony & Buyer Power” panel. Sandeep argued that antitrust enforcers should “target strong employers, including through merger law, and allow all workers to organize.” Politico’s Morning Tech newsletter coverage of the hearing reported Sandeep’s criticism that the FTC “needs to show it’s willing to flex its enforcement muscles.” And Latham & Watkins attorneys took note of Sandeep’s testimony in a report for Lexology.

Matt Stoller wrote an op-ed in The Guardian pointing out that Amazon underpaying its workers is “For sure … a problem, but it is not the central challenge of Amazon. The real problem with Amazon is that Jeff Bezos controls essential infrastructure upon which nearly all American citizens rely, and he uses it to serve himself.”

Barry Lynn spoke at Concurrences’ annual conference at George Washington University, which is co-hosted by former FTC chairman William Kovacic, on the question “Where is Antitrust Policy Going?” Barry urged modern defenders of the “consumer welfare” philosophy of antitrust enforcement to study the idea’s origins among left-wing thinkers who aimed to promote “a command-and-control” vision of economic organization.

Barry Lynn talked about Open Markets and why the country needs to use antitrust laws to address increased concentration and power across the economy, especially the power held by platform monopolists like Google, Amazon, and Facebook, on C-SPAN’s “The Communicators.

Lina Khan’s YLJ article was covered by Matthew Yglesias in his coverage for Vox of the EU’s new investigation into Amazon. Other recent coverage of Lina and her work includes articles in Business Insider, The Daily Herald, Gothamist, Politico’s Morning Tech, The Sharon Herald, The Sidney Morning Herald, Vanity Fair, and two op-eds by Robert Kuttner in The Huffington Post and The American Prospect.

Matt Stoller spoke at the Lincoln Network’s Reboot Conference in San Francisco talking about some of the harms that technology giants pose and why they need to be broken up or tamed.

Barry Lynn took part in a debate hosted by the International Inequalities Institute, at the London School of Economics titled “Choosing to Be Smart: Algorithms, AI, and Avoiding Unequal Futures.”

Barry Lynn spoke on the main stage of Slow Food’s annual Terra Madre conference in Turin, Italy. The two hour discussion with agricultural economist and author John Ikerd was titled “Profit or Sustainability: Comparing Models for Tomorrow’s Economy.”

Matt Stoller spoke at Vrije Universiteit in Brussels last week about the ways large online platform corporations threaten the liberty and economic well-being of citizens of the democracies in the United States and Europe.

Gizmodo’s coverage of Attorney General Jeff Sessions’ meeting with state attorneys general about the power of big technology platform quoted Matt Stoller who pointed out, “This could be a HUGE deal. The Microsoft case started as a multi-state inquiry at a state level, then moved to a DOJ case to break up the giant.”

Coverage of Amazon’s announced minimum wage increase relied on Matt Stoller for context. Stoller explained to The Verge, Politico’s Morning Tech, and Digital Journal, that the raise can at least partly be described as “an attempt to ward off antitrust action” and that “the pushback it is getting from its anti-competitive behavior is not going to stop.” Similarly, Matthew Yglesias at Vox covered the pay raise and noted building scrutiny of Amazon, writing, “Lina Khan’s fairly radical proposal to reshape the foundations of American antitrust doctrine has made a ton of intellectual headway over the past three years.”

An op-ed in The Washington Post from an editor at the Global Competition Review described Open Markets as the “pro-enforcement” side of the growing debate about antitrust. The op-ed criticizes the selfish motivations behind Alex Jones’ important criticism of technology giants’ power and the real risk that Jones creates of making antitrust enforcement look partisan.

Matt Stoller told Quartz that the new United States-Mexico-Canada Agreement includes a major provision sought by internet platform monopolists such as Google and Amazon. The provision is similar to Section 230 of the Communications Decency Act of 1996, which establishes that websites shall not be considered the speaker or publisher of third-party content on its site. Courts have used Section 230 to immunize platforms from lawsuits dealing with content from third-party users.

The SEC’s Robert Jackson Tells OMI How Wall Street Fees Hurt Upstart Businesses

In April, Securities and Exchange Commission Commissioner Robert Jackson gave a speech at the Greater Cleveland Middle Market Forum, titled “The Middle-Market IPO Tax.” He showed that investment banks uniformly charge small and midsize businesses – defined as those valued at less than a billion dollars – much higher fees for handling their Initial Public Offerings, regardless of the company’s specific characteristics, other than size.

Such midsize upstarts must routinely pay 7 percent of their IPO proceeds to their bankers, whereas larger companies pay much lower rates. (Facebook famously negotiated a 1 percent IPO fee.) Jackson says this means smaller businesses are at a competitive disadvantage with larger businesses right from the get go.

Open Markets talked with Commissioner Jackson about the “middle-market IPO tax,” what it says about competition in financial markets, and why this issue, he says, “keeps me up at night.”

OMI: Why does this happen? What stops small and mid-sized companies from finding some other underwriter that can give them a better deal?

Jackson: Over the years, our capital markets have become less and less competitive as big broker dealers and big investment banks dominate. The fewer of them there are, the less competition there is to drive down prices.

Twenty years after I left Wall Street, given all the technological change we’ve had, the price to take a company public has not gone down at all.

OMI: Could more competition in banking and finance give small and mid-sized companies more options and lower fees?

Jackson: Absolutely. One of the things that the SEC and other federal regulators have forgotten is that a lot of what ails corporate America right now could be cured by a very American, very traditional, medicine, which is competition.

That’s true in investment banking, in accounting, in the proxy-advisor space, and in the asset management space, which has more concentration than ever.

The bottom line is that the SEC is sworn to protect investors, and investors benefit from competition. We just haven’t done a good enough job making sure there’s competition over IPOs, which is why companies are paying the middle-market IPO tax.

OMI: What can the SEC do that would promote competition?

Jackson: The SEC has not paid nearly enough attention recently to the competitive effects of the choices that we make. The SEC really should be thinking systematically about, every time we make a regulatory decision, or a decision to deregulate or not to regulate, what that will do for competition in the marketplace.

OMI: Are there other actors who benefit from this investment bank cartel?

Jackson: I spent time talking to owners of middle-market businesses. They tell me, “Because the private equity firm knows that we have to pay seven percent to go public, they don’t give us competitive offers. They know that we have no choice but to use private equity.”

Not only are we keeping great, young companies from going public, but we’re handing a gift to private equity investors who don’t have to compete with our public markets to provide low-cost capital. That’s how it really hurts companies, because they end up having to take on investors without a real chance of accessing our public capital markets, which is what I think every American business ought to be entitled to.

VITAL STAT: $9,000,000,000

Amount Google paid Apple to be the default search engine on its iPhones’ Safari browser in 2018, according to a Goldman Sachs estimate reported on by Business Insider. That’s more than Apple makes on its iCloud or Apple Music products.

WHAT WE’RE READING:

“How SiriusXM’s Purchase of Pandora Could Change the Balance of Power in the Music Industry” (Slate, April Glaser): Why SiriusXM’s $3.5 billion acquisition of Pandora threatens to consolidate power in the music industry and hurt artists.

“The Case for Breaking Up Facebook and Instagram” (The Washington Post, Tim Wu): How the Obama-era FTC messed up Facebook’s acquisition of Instagram, and how today’s can fix it.

“Apple Tight-Lipped on Removal of Freedom and Other Content-Blocking Apps” (Fast Company, Steven Melendez): Thorough reporting on how Apple eliminated a website-blocking application from its App Store, coincident with the technology giant’s unveiling its own, competing app.

Written by Barry Lynn, Phil Longman, and Matt Buck.

Edited by Barry Lynn, Phil Longman, Matt Buck, Katherine Dill, Claire Kelloway, Matt Stoller, and Sandeep Vaheesan.

Image by Jay Lazarin via iStock.